Applying for an auto loan or a mortgage can be difficult and frustrating if you do not have good credit. Negative items like collections, charge-offs, and missed payments can be hard to recover from. There is hope. Our credit counselors dig deep and will create a one-on-one action plan that will fix your credit score safely and effectively. We work with you to remove inaccurate items and dispute discrepancies on your credit report. What makes us different? We work on your ENTIRE report at once. This means we remove items all at once, not one item per month like other companies. After your score has improved, we continue to monitor your credit and offer credit tips and healthy spending habits.

One-on-One Action Plan With a Certified FICO© Professional

1 The first step is to analyze your credit report and carefully identify any errors and inaccurate information. We also make sure that your personal information is reporting correctly.

2 The next step is to challenge and dispute any inaccurate, incomplete or outdated information hat is being reported on your credit report. During this step we’re leveraging the laws under the FCRA to protect your consumer credit rights.

3 Finally, we provide you with your own client portal so you can check your credit scores as items are getting deleted from your report. Throughout this journey, we will provide you with all the tools and resources so you’re in the loop at all times.

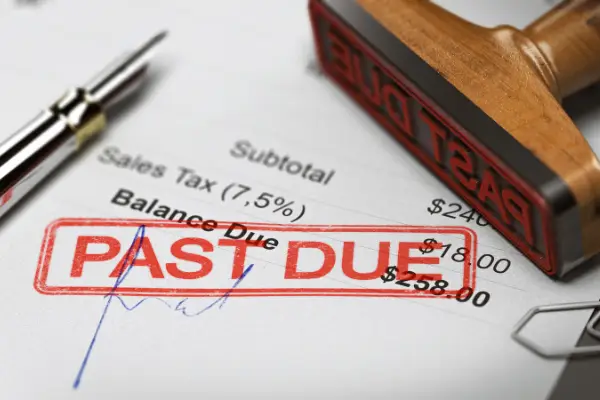

Cease and Desist Letters to Collection Agencies

If a debt collector continues to contact you, and no debt is owed, a cease and desist letter is the next step. The federal Fair Debt Collection Practices Act (FDCPA) gives you the right to force a debt collector to stop communicating with you. Before this happens make sure you have proof that you either paid the debt off, or definitely do not owe the money. Not sure how to go about this? Ideal Credit Solutions is here to help.

Debt Validation Letters to Creditors

In 2020, the federal Trade Commission (FTC) received around 82,700 complaints from consumers about debt collectors, and a whopping 49% of those complaints were to report attempts to collect debt they didn’t owe!* If you receive an attempt to collect an outstanding debt, do not pay it immediately. This is why a debt validation letter is so important. We help differentiate what is mistaken debt, and real debt.

When we send a collector your debt validation letter, the company is supposed to send back a debt validation letter supporting its claim. If it can’t or won’t, the claim is likely to be dropped. When you work with Ideal Credit Solutions, this is just one of the steps we take to fix your credit history and score.

*https://files.consumerfinance.gov/f/documents/cfpb_fdcpa_annual-report-congress_03-2021.pdf

Monthly Plan with Unlimited Dispute Letters Available

Our monthly plan includes unlimited dispute letters to the 3 credit bureaus and each individual creditor. Whether you have 1 negative item or 100 negative items, we will automatically send unlimited dispute letters to maximize the probability of achieving your desired outcome.